Cholamandalam Health Insurance

Chola MS General Insurance Company Limited is a Joint Venture between the Murugappa Group and Mitsui Sumitomo Insurance Company Limited, Japan. Chola ...Read More

Network hospitals

12000+

Claim settlement ratio

93.63%

Sum insured

Up to5 Crore

No. of Plans

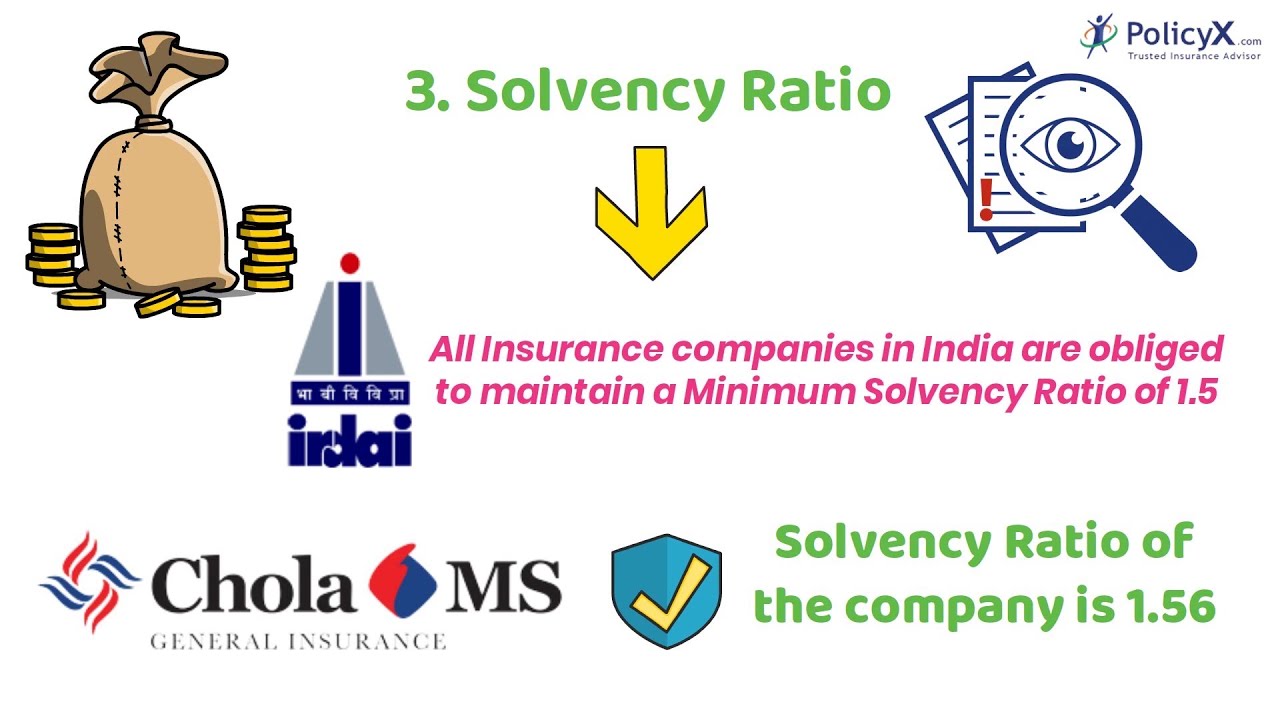

1Solvency Ratio

2

Pan India Presence

198+

Choose 1st Company

Choose 2nd Company

Compare

Best Selling Cholamandalam Health Insurance Plans

Let's take a look at the list of health insurance plans that offer comprehensive protection to you and your family

-

Individual and Family Health Insurance

Cholamandalam Health Insurance Plans Eligibility Approximate Annual Premiums Chola MS Flexi Health Entry Age - 18 to 65 years

Sum Insured - Up to 25 LRs. 3074

Key Features Of Cholamandalam Health Insurance

Let us take a look at some unique features of top-selling Cholamandalam Health Insurance policies:

For Individual and Family Health Insurance

Chola MS Flexi Health

A personalized health insurance plan by Cholamandalam Health Insurance with a flexible sum insured ranging between 1 L to 25 L. It is an ideal plan for young individuals and families.

Why Do We Recommend This?

- Restoration benefit available

- Recharge Benefit available

- Medical second opinion covered

Recommended Videos

Why Choose Cholamandalam Health Insurance?

- Versatile and affordable health insurance plans for every need

- 24X7 customer support for easy claim settlement

- Over 12000 network hospitals all over India

- Offers comprehensive coverage at affordable premiums

- Tax benefits under Section 80D of the Income Tax Act

A Quick Outlook

| Cashless Claim Settlement | 70 minutes |

| Minimum Entry Age | 3 months |

| Maximum Entry Age | 65 years |

| Sum Insured | Upto Rs. 5 Crore |

| Network Hospital | Over 12000 |

| Tax Benefits | Upto INR 1 Lakh |

| Solvency Ratio (2022-23) | 2 |

| Claim Settlement Ratio (2022-23) | 94.5% |

| Ambulance Expenses | Covered |

| Coverage for Accidents | Yes |

Cholamandalam Health Insurance Plans

Cholamandalam Health Insurance offers customized health insurance plans and complete health covers. Have a look below.

-

Individual Plans

Cholamandalam Health Insurance offers several types of individual plans. These plans offer coverage for one person only.

-

Family Floater Plans

Family floater plans are specifically designed for people having a family. You can consider this plan if you want to secure your spouse, kids, and parents as well under one plan.

-

Senior Citizen Plans

The plans are specifically designed for people aged 60 and above. The premiums of these plans might be high but offer complete coverage.

-

Top-Up Plans

Top-up plans work when your normal health insurance plan is not enough for your complete coverage. It will give additional coverage in case your base health insurance policy is exhausted.

Why Choose Online Procedure to Buy Health Insurance Policy?

Getting a medical insurance policy online from PolicyX or directly from the company is full of benefits. Read below to know more:

-

Easy to Compare:

Online platforms give access to compare different health plans at the same place. You can pick the right one for you while comparing the premiums. -

Buying Insurance within 5 minutes:

On an online platform, you can choose and buy your policy within 5 minutes, without any extra hustle. -

24*7 Customer Service:

The experts are always at your service. No matter what the time is, you can contact them any time to clear your doubts. -

Instant Quote:

With online accessibility, you can get quotations with just one click. You can collect several quotes and choose the right one for you.

What Are The Different Waiting Periods In Cholamandalam Health Insurance Plans?

The various waiting periods associated with CholamandalamHealth plans are:

Initial Waiting Period

Begins from the date of purchase and lasts for up to 30 days for most Cholamandalam Health Insurance plans.

Pre-existing Disease Waiting Period

Cholamandalam Health Insurance plans require you to serve specific waiting periods in case you are diagnosed with PEDs such as hypertension, diabetes, or any other.

Survival Period

Like waiting periods, Cholamandalam health insurance plans with critical illness coverage have a survival period. During this period policyholders diagnosed with any listed critical illness must outlive the survival period to enjoy coverage benefits.

Documents Required For Cholamandalam Health Policy Claim Settlement

Submit the following documents when filing for Cholamandalam health claims:

- Duly completed and signed claim form, in original

- Valid photo-ID proof

- Medical practitioner's referral letter and prescription

- Original bills, receipts, and discharge cards from the hospital/medical practitioner

- Original bills from pharmacy/chemists

- Original pathological/diagnostic tests reports/radiology reports and payment receipts

- Indoor case papers

- First Information Report, final police report, if applicable

- Post-mortem report, if conducted

- Any other document as required by the company to assess the claim

More Queries?

If you have any more queries regarding

Plans,

Renewals, or Claim Procedures, contact our insurance experts at:

1800-4200-269

now!

Other Health Insurance Companies

Compare mediclaim policies with other top insurers in India.

Know More About Health Insurance Companies

Share your Valuable Feedback

4.4

Rated by 2638 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Simran Saxena

Simran has over 3 years of experience in content marketing, insurance, and healthcare sectors. Her motto to make health and term insurance simple for our readers has proven to make insurance lingos simple and easy to understand by our readers.

Reviewed By: Anchita Bhattacharyya

Reviewed By: Anchita Bhattacharyya

Do you have any thoughts you’d like to share?